| |

African-American Career World Magazine, launched in 2001, is the recruitment link between students and professionals who are African American and the employers that seek to hire them.

The publication includes career strategies, industry trends, and role-model profiles that target the African-American community.

This magazine reaches students, graduate students and professionals at their home addresses.

If you are an African-American college student or professional, African-American Career World is available to you FREE!

|

|

African-American

African-American

Career World

» Featured Articles

» Subscription Information

» Reader Survey

» Companies Actively Recruiting

GENERATING WEALTH, SAFEGUARDING THE FUTURE

Barbara Woodworth

Long a staple in the career arena, the insurance sector is increasingly becoming a sought after career for African-American professionals.

Companies such as CNA Insurance, New York Life Insurance Company, the Chubb Group of Insurance Companies and John Hancock Retirement Planning Services not only recognize the need to better acquaint African-American consumers with products designed to improve their financial lives, they also seek out exemplary employees such as Crystal Brown,

Eugene Mitchell, Kenneth Stephens, and George Blount, respectively, to accomplish this endeavor.

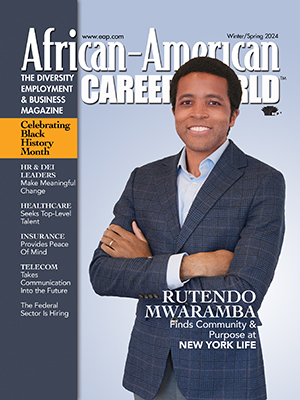

CREATING WEALTH AT NEW YORK LIFE

Reflecting on the experiences that most prepared him for his current position as corporate vice president/market manager African American Unit at New York Life Insurance Company, Eugene Mitchell looks back on his four years as a corrections officer while working on his undergraduate degree. “I saw firsthand the complexities of the justice system and the impact historical challenges in communities of color have on the lives of the young men who live there,” says Mitchell. “This experience opened my eyes to the need to introduce financial tools to redirect poor spending habits and generate financial opportunities for individuals and communities.”

After graduating from the Stern School of Business, Mitchell intended to pursue a career in finance at a technology company. With jobs scarce, he followed the suggestion of a friend and former mentor and applied for a position at New York Life, headquartered in New York City, where he was hired into a high profile MBA Leadership Development Program that jumpstarted his insurance career. Noting that he was always intrigued by the role of insurance and financial services in creating generational wealth, Mitchell comments on New York Life’s impact as an industry leader. “In 1957, the company broke the color barrier by hiring the first African-American financial services professional,” says Mitchell who, when joining New York Life 13 years ago, was given the opportunity to study the African- American insurance market.

As leader of the company’s African-American market, Mitchell’s challenges include building and maintaining a sales and leadership team of African-American professionals. “My specific charge is leading an agentdriven movement to create $50 billion in tax free transferable wealth in the African-American community over a five-year period,” he says.

Over the past three and one-half years, Mitchell’s team is not only well on its way to reaching its goal - having already placed $25 billion in life insurance face amounts – they have also insured more than 115,000 lives. “This agent-led movement has resulted in increased financial literacy, changed the perception of leveraging foundational assets, and advanced the understanding of wealth as the basis for financial opportunity,” he states.

One of the key essentials for building a successful career, according to Mitchell, is starting with a purpose that aligns with your beliefs and presents you with an opportunity to make a difference in your community, your company, and with your customers – in short, a purpose larger than yourself.

“Have a mission, develop the ability to carry out a successful plan to meet and exceed company objectives, and care enough about the outcome in a personal way,” he recommends. On the job, Mitchell’s greatest satisfaction comes from sharing the knowledge that leveraging the financial tools and services, provided by companies like New York Life, to individuals, communities, groups, organizations, and institutions can create legacies and generational wealth.

“Wealth provides opportunity and I enjoy guiding my agents in their efforts to help their communities make sure such opportunities become reality,” Mitchell says.

New York Life, with a current field force of approximately 12,000, is always looking for individuals able to handle high-level sales and marketing assignments. The company has an extensive training program for agents and embraces those with and without prior insurance experience at the company’s 120 community-based offices throughout the country.

“Our work to instill financial literacy reform is changing lives and creating opportunities for education, jobs, homeownership, and creation of new businesses in the African-American community. New York Life’s agent-led movement to insure 200,000 individuals at a minimum face amount of $250,000 will create $50 billion in protection and tax free transferable wealth,” says Mitchell.

He is proud to take a lead position in this crusade to empower his community and to share his belief that anything is possible – big or small – when individuals make their purpose personal and larger than themselves.

GIVING MORE THAN EXPECTED AT CHUBB GROUP

During his 28-year career at Warren, NJheadquartered Chubb Group of Insurance Companies, Kenneth Stephens, RPLU, has held positions of increased responsibility. Beginning in Chubb’s Detroit branch office, he gained experience in a variety of executive protection insurance products. He advanced to the St. Louis Office where he served as senior underwriter and department manager, followed by worldwide fidelity insurance manager in New Jersey. He was also mid-Atlantic zone and northern zone manager before assuming his current role as senior vice president and western territory manager for Chubb’s specialty business. Today, he is accountable for Chubb’s specialty business in 22 offices, accounting for one-half of the insurer’s U.S. specialty insurance premiums.

A graduate of Western Michigan University with a BA in finance and marketing, Stephens learned to thrive outside his comfort zone at an early age. “At 12, armed with a memorized sales script, a kit of detergent, soap samples, and order sheets, I sold products to neighbors within a three-block radius,” he recalls. “Experiencing family moves during my youth further enabled me to quickly adapt to new environments,” adds Stephens, who worked in five cities since joining 10,000-employee Chubb - an experience that provided him with professional and personal advantage.

Recognizing his interest in finance and business as a college student, Stephens enrolled in an insurance elective during his junior year. “The class, taught by an independent agent who owned an agency with her husband, opened my eyes to the ever-expanding and multidimensional aspects of the industry,” relates Stephens. “It didn’t take me long to realize that insurance is much more than just selling. It involves underwriting, actuarial, marketing, product development, and more.”

Awed by the scope of the sector, Stephens, unlike many of his fellow students, chose insurance rather than the then perceived more glamorous field of banking. He interviewed with Chubb and after several rounds was selected for one of three available trainee slots in Michigan.

“There is significant competition in this field,” acknowledges Stephens. “As Chubb endeavors to sell its products through independent agents and brokers, underwriters from other companies vie for the same prospective customers – a challenge for Chubb who seeks to write new business and retain current accounts , but on their own terms,” he explains.

Stephens enjoys leading and encouraging team members to achieve profitable growth. He takes pride, as well, in interacting with agents and brokers who partner with Chubb and work to provide great products and services. “As an underwriter I also enjoy the art of the deal – putting together a program of insurance coverages and services designed to help protect customers,” he says.

As for the skills and advice he imparts to others, Stephens identifies analytical and communication skills and a sense of curiosity as essential. And because underwriters must analyze risks and exposures, it is important that they be aware of what is happening with the economy and in the business world. He finds it critical to respond positively when presented with new opportunities and advises against underestimating the value of a situation deemed a small beginning. “Every interaction counts, so be present and give more than expected,” he stresses. To build resilience, he advises doing something difficult - even lonely - every year, something that stretches you beyond your comfort zone and requires unwavering focus.

A proponent of volunteering in the community, mentoring formally and informally, and working to increase opportunities for people of color, as he did during his tenure as a board member for Chubb’s Multicultural Development Council (MDC), he highlights the proudest moment of his career - his work on Project Horizon, a corporate initiative that brought together select individuals working in teams to analyze aspects of the company’s business and determine how best to move forward over the next seven years. “As team leader, I was chosen to present the project’s results to Chubb’s board of directors, an honor I cherish along with appreciation for the team’s efforts, support, and final work product,” he says.

WELL-POSITIONED AT CNA INSURANCE

Chicago-headquartered CNA Insurance is on a hiring tear. This worldwide company of 7,000 has numerous positions available in a variety of capacities and locations. “I’m still awed that this industry encompasses so many sectors,” comments Crystal Brown, an assistant vice president, healthcare northern zone leader at CNA, who has been in the insurance business for 25 years. “Underwriting, risk control, corporate communications, finance, and legal are only a few of the jobs often found on www.cna.com/careers.”

Brown, a Eugene Wilson scholar and INROADS intern, majored in English while attending Amherst College. However summers interning at AIG exposed her to the world of insurance, including underwriting, claims, and risk control. It was underwriting that most captured her interest. “It is outward facing, allows for analytical work, and encourages building relationships with external individuals leading to increased business,” she explains. At graduation, finding no available positions at AIG, her INROADS sponsor, Brown look - ed to other sponsoring companies. In 1989 she was hired at Continental Insurance Company, which in 1995 was acquired by CNA.

Following the merger Brown, then a senior underwriter with a master's of public administration from New York University’s Robert Wagner School, transferred from New York City to Chicago to help blend the two companies.

When CNA realigned healthcare into six regional zones, a new position was created for Brown. As with any redirection and advancement, there were challenges. “The company has gone through a number of positive cultural changes,” she states. “Underwriters are in the process of developing more sales acumen; a situation not everyone is comfortable with. The same was true during the first year of realignment.”

As a high-ranking, key manager within the underwriting operation, Brown successfully meets the challenges by offering extensive training, additional resources, small and large group meetings, and relying on her business and people skills to encourage her team of 16, as well as those she indirectly interfaces with.

According to Brown, it is particularly important for those in the insurance industry to develop strong relationships with co-workers and clients; relationships that can withstand the ups and downs of the industry. “Solid relationships are the basis for resolving issues,” she contends. Technical skills are important, as is team building, being impactful, establishing strategies and goals, being proactive, and building your own brand.

“By never giving up, looking for growth opportunities, increasing your network, and providing value to others, business opportunities will flow,” says Brown. “The insurance industry is a wonderful avenue for career development. There are so many directions to pursue – areas that don’t initially come to mind as being part of the business.”

In addition to the work itself, Brown also enjoys the people she works with; many with whom she has built long-term relationships. An active mentor, she was awarded the Windy City Woman of Color award in 2012 and is a member of the professional organization, Professional Liability Underwriting Society (PLUS).

An integral part of her job is recruiting. “I continually work with recruiters to build a pipeline of talent and network in and outside of the company,” Brown says. ”I’m dedicated to letting people know that CNA is truly a great place to work.”

PURSUING A NOBLE PATH AT JOHN HANCOCK

With an associate degree in finance, a bachelor’s in management, a MBA with special emphasis in enterprise risk management, and a nearly completed doctorate in business administration, George Blount is well prepared for his position as internal sales manager at John Hancock Retirement Plan Services.

Nine years into his tenure at Bostonhe-adquartered John Hancock, Blount credits the five years he spent as a financial advisor and equity trader, and his 12 years in retirement planning services-distribution of small to mid-size defined contribution plans, as invaluable preparation. “I oversee our team of internal wholesalers and provide guidance in business strategy to ensure that our team and external wholesalers are successful marketing our defined contribution plans throughout the United States,” he states.

Noting that over the past 30 years, employees were obligated to manage their retirement savings in much the same way as past institutional pension plans, Blount explains that his early work at an online firm allowed him to see the negative impact of self-directed financial activities. “Movement in the financial market can be intimidating. Without a watchful eye the possibility of loss is real. At the end of the day, whether it is trading or retirement planning, individuals need help to ensure successful outcomes,” he comments.

What drew Blount to the financial services and companion insurance industry is that it is based on trust – trust in the individual who sells the product and trust in the companies that distribute them. “The company you work for should complement your personal brand and vice versa,” says Blount. He learned the business at smaller firms and elected to move to a company with a great brand at a time when he felt his personal brand was at an acceptable level.

For Blount, moving to a larger organization was also based on the “noble idea” of satisfying the financial needs of an underserved population by providing advice to those who needed it most. Soon realizing that the advisory model was not set up that way, and that the concept of profit and loss did not support long cycles, he became disillusioned and even thought about leaving the industry. “I could not see myself remaining in a business where I felt I could not be of help to people,” he remarks. An opportunity to sell retirement plans was just what he needed. “I jumped at the chance and now, 12 years later, this business continues to energize me,” he says.

Of the challenges he faces, Blount is clear: “Our country is facing a retirement crisis. The number of individuals who have underfunded retirement savings is staggering,” he remarks, adding that the deficit between what people need for retirement and what they have saved is estimated to be greater than four trillion dollars. “Financial literacy is a global issue,” he says. “With increased financial product innovation the need for education is higher than at any time. Our challenge is similar to that of most firms in this industry – awareness and innovation. We must innovate new ways to deliver and educate the population on financial matters in a self-directed environment.”

Most necessary for success, according to Blount, are empathy and perseverance. “The ability to understand the motivations, needs, and fulfillment of customers' needs is critical,” he states.

He also emphasizes the importance of having a career vision. A job title or ideal salary in isolation says very little about your goals, he contends. “You should be able to describe in detail where you plan to start and finish. It is necessary to be able to identify the value of your experiences,” says Blount.

“Let a company invest in your future, but not your history,” he advises. As an aside he mentions learning one of the most important lessons of his career from the video game, Super Mario Brothers. “The only goal was to save the princess. There were no instructions – the lesson being - set your goal and accomplish it.”

At John Hancock, Blount enjoys working in his niche. “Unlike most financial products, the end-user of retirement plans is the average U.S. employee for whom semi-monthly payroll deductions into defined contribution plans represents the best form of saving,” he explains.

Blount appreciates being able to help hundreds of people achieve their retirement goals and also enjoys serving on the company’s multi-cultural employee resource group, The Association for MultiCultural Professionals (AMP). As chair, his responsibilities include communicating information, coordinating sub-committee events, and advocating the business advantages of workplace diversification.

“We have the an employee base who are full of optimism for the future of the company, and that’s a nice position to be in,” says Blount.

» Feedback for the Editor

» Feedback for the Editor

» Request Article Copy

|

|